Book Reviews

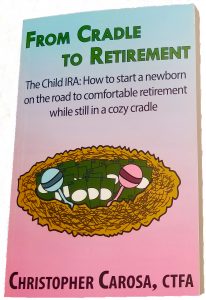

From Cradle to Retirement: The Child IRA

How to start a newborn on the road to comfortable retirement while still in a cozy cradle

Book Reviews:

“Chris Carosa has taken Robert Fughum’s best seller, All I Really Need to Know I Learned in Kindergarten, one step further. Chris, a noted publisher and author, has come up with a very simple and novel lesson even before kindergarten. It’s the Child IRA which can help a child get started on the road to financial independence. It’s never too early to start.”

- Jerry Kalish, GFS®, President, National Benefit Services, Inc.

“The retirement crisis in America is a concrete reality for millions and yet, somehow, still hard to fully grasp. This is partly because its historical underpinnings have become cloaked in myth over the years, but also because few so-called experts have any good suggestions as to how individuals can effectively respond to it, beyond easy bromides such as ‘save more’ or ‘retire later.’ Chris Carosa has written a brilliant book that explains how we ended up in our current predicament but which, more importantly, sketches out an effective way forward, based on a lifetime of earnings and savings, rather than on just a career’s worth. I can’t recommend From Cradle to Retirement highly enough.”

- Stephen Rosenberg, Esq., The Wagner Law Group

“The Child IRA can be one of the greatest ways to build wealth for the next generation – helps get kids in the habit early and starts meaningful conversations and interest.”

- Dave Bensema, Regional Director of Wealth Planning, BMO Private Bank – Illinois

“Chris Carosa, a well-respected author, advisor and industry thought leader, is on a mission to educate families on building wealth for future generations. The Child IRA should be the first step in the planning process for establishing and/or securing a family’s legacy.”

- Jonathan Epstein, Institutional Sales Director at ThirtyNorth Investments & President of DCALTA

From FiduciaryNews.com Articles:

“The Child IRA is a common sense solution and should be part of the bigger approach to fixing our retirement system. Congress must consider this and work out the tax structure aspect so future generations have money, sustainable for retirement. These are the kinds of ideas that I think young working Americans can get excited about. It helps them be “for” something rather than worry about something they inherently feel will not be there for them when they reach retirement age. I think there is still much to be worked out with the Child IRA idea but it is a start and I fully endorse new solutions to America’s retirement crisis, not the same old, same old.” (August 18, 2015)

- Congressman Tom Marino, 10th District, Pennsylvania

“The Child IRA could be an incredibly powerful tool for combatting not only the looming retirement crisis, but also the long-term care burden that my and future generations are likely to face as our parents get older. When it comes to compound interest, the longer your investing horizon, the less you have to contribute to achieve outstanding results. Mathematically, starting to save for retirement as a newborn could drastically reduce the savings burden in your working years. Not to mention it would likely do an enormous favor to the child from a financial literacy perspective. I absolutely plan to take advantage of this when my husband and I have children. Obviously, not every child is cut out to be a model, but as you mention in your articles, there are other ways for children to earn enough income as they get older to catch up. For example, I’ve been working since I started babysitting at eleven years old. I wish I had known enough to take advantage of a Child IRA.” (November 15, 2016)

- Tara Falcone, CEO, Founder, ReisUP